According to the SEC, a stop order “is an order to buy or sell a stock once the price of the stock reaches a specified price, known as the stop price.” Whether you are trading on Stock-Trak or your actual brokerage account, stop orders can be very useful and efficient when managing your portfolio. As you may know, there are four actions that can be performed by the trader: buy, sell, short and cover. For all these actions, we will review how to efficiently place a stop-order and what is its usage.

Stop-Buy order:

- What is a Stop-Buy order and when should I create this?

- A Stop-Buy order is an order that will be transformed to a market order only when the market price reaches the stop price or above. To have an efficient Stop-Buy order, you will have to place a target price that is higher than the market price.

- You should create this order if you wish to purchase a stock once it has passed a target price. As an example, let’s pretend you just read some positive news on stock ABC and expect the stock to soar. If you wish to see a little increase before jumping in, you can always create a Stop-Buy order so the system will include stock ABC in your open positions and be able to profit from “thereafter” rise.

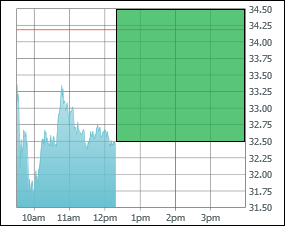

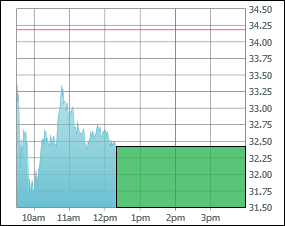

- Graphically, what does it look like?

-

- To create an efficient Stop-Buy order, you would have to place an order with a target price in the green region.

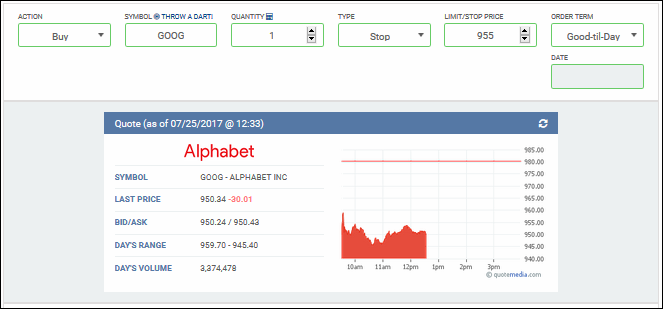

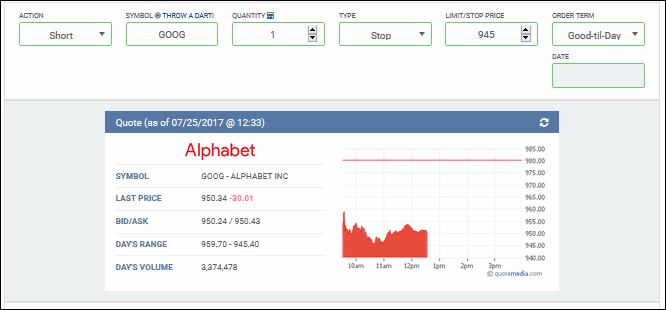

- How to place it on HTMW

- Make sure to review the ask price and to switch the order type to “Stop”. You can also adjust the order term according to your preferences.

Stop-Sell order:

- What is a Stop-Sell order and when should I create this?

- A Stop-Sell order is an order that will be transformed to a market order only when the market price reaches the stop price or below. To have an efficient Stop-Sell order, you will have to place a target price that is lower than the market price.

- You should create this order if you wish to sell a stock once it reaches a specific target price. This will help you manage your portfolio and automatically send a market order to sell your order once it reaches the price for which you wish to close your position immediately. In other words, it is useful in cutting your losses.

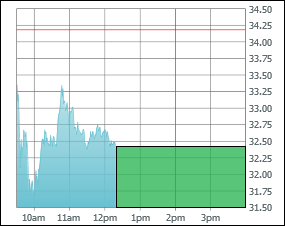

- Graphically, what does it look like?

- To create an efficient Stop-Sell order, you would have to place an order with a target price in the green region.

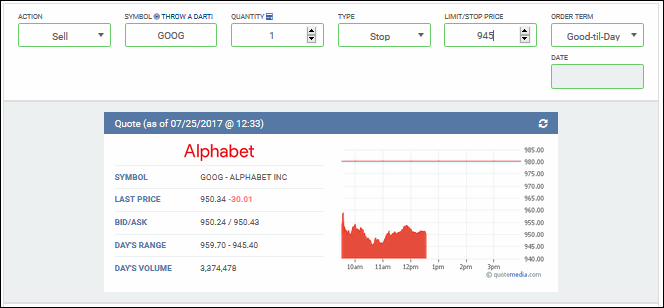

- How to place it on HTMW

- Make sure to review the bid price and to switch the order type to “Stop”. You can also adjust the order term according to your preferences.

Stop-Short order:

- What is a Stop-Short order and when should I create this?

- A Stop-Short order is an order that will be transformed to a market order only when the market price reaches the stop price or below. To have an efficient Stop-Short order, you will have to place a target price that is lower than the market price.

- You should create this order if you wish to short a stock once it has passed a target price. As an example, let’s pretend you just read some negative news on stock ABC and expect the stock to tank. If you wish to see a little decrease before making a move, you can always create a Stop-Short order so the system will short sell stock ABC in your open positions and be able to profit from “thereafter” drop.

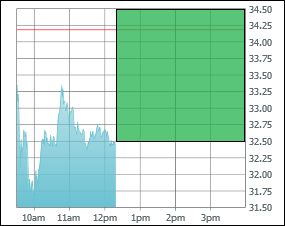

- Graphically, what does it look like?

- To create an efficient Stop-Short order, you would have to place an order with a target price in the green region.

- How to place it on HTMW

- Make sure to review the bid price and to switch the order type to “Stop”. You can also adjust the order term according to your preferences.

Stop-Cover order:

- What is a Stop-Cover order and when should I create this?

- A Stop-Cover order is an order that will be transformed to a market order only when the market price reaches the stop price or above. To have an efficient Stop-Cover order, you will have to place a target price that is higher than the market price.

- You should create this order if you are currently in a short position and wish to cut your losses at a specific target price. By creating a Stop-Cover order, it will help you manage your portfolio in an automated manner.

- Graphically, what does it look like?

- To create an efficient Stop-Cover order, you would have to place an order with a target price in the green region.

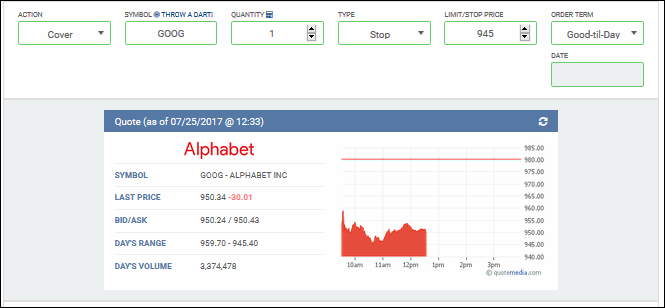

- How to place it on HTMW

- Make sure to review the ask price and to switch the order type to “Stop”. You can also adjust the order term according to your preferences.

Investing in Chile

Investing in Chile How to Prep for the GRE and How a Master’s Degree Can Boost Your Career

How to Prep for the GRE and How a Master’s Degree Can Boost Your Career Forex Trading and the Importance of Time Frames

Forex Trading and the Importance of Time Frames