Contest: March Trading Strategy

Final Portfolio Value: $101,169.24

Trading Strategy For This Contest

Trading Strategy: Investing for the first time in the stock market is very overwhelming; even if it is done with virtual money. I’ll start saying that implementing a strategy takes a lot of practice and patience. You must begin understanding some of the “tools” and “terms” involved. Without this basic knowledge, it is difficult -if not impossible- to practice your new skills properly.

At first I didn’t know where to start, so I decided to see the most active stocks and the biggest gainers, because I believe that learning from the best stock market winners can guide me to tomorrow’s leaders. After I had some training ideas, I decided to do a fundamental analysis. I looked carefully at a company’s earnings, earnings growth, sales, profit margins, and return on equity among other things. Doing this analysis definitely helped me to narrow down my choices.

I always like to keep in mind some great clichés “The trend is your friend”, “buy low and sell high” and “buy high and sell higher”. When I had a couple of stocks ready to trade, I made sure they where diversified and they where from the leading industry groups or sectors. I noticed that the majority of past market leaders were in the top industry groups and sectors.

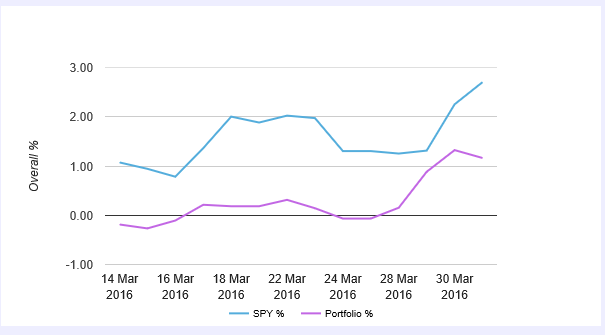

Another strategy that I used was to track the general market given that most stocks usually follow the trend of the general market. The general market is represented by leading market indices like the S&P500, Dow Jones Industrials, and the NASDAQ Composite.

When I had my portfolio ready, this was just the beginning. Even though I didn’t check my portfolio every 2 hours or every single day, at least 3 times a week, I read the latest news about the stocks I bought and about the market in general. After that, I also checked the chart price and volume action, this helped me recognize when a stock has reached its top and It helped me decide if I should sell my stock or not. Finally, I always made a post-analysis of my stock market trades. That way I could learn from my successes and mistakes.

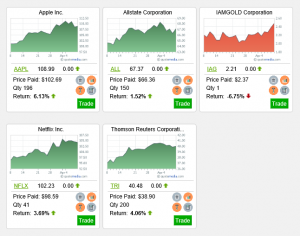

Final Open Positions and Portfolio Allocation

Performance Over The Total Contest

Are Bitcoin Prices Bumping Up Again?

Are Bitcoin Prices Bumping Up Again? Essential Things You Need To Know About Stock Market

Essential Things You Need To Know About Stock Market