*** Updated with Stock Prices and Returns as of May 4, 2024 ***

Today, we are here to bring you our Motley Fool Rule Breakers Review.

But first, I want to ask you a question…Have you heard of “buy-and-hold” investing?

I am going to assume that most of you are well-aware.

But for those who need a refresher, buy-and-hold investing entails buying stocks and holding those stocks for long periods (5 years or longer), regardless of market activity.

Therefore, you tolerate short-term price fluctuations because over time you believe that solid, profitable companies will recover and continue to rise in stock price.

The classic buy-and-hold strategy may not be “exciting” in the traditional sense. It is not a get-rich-quick-scheme. It is what I call a get-rich-slowly scheme……but it can produce exciting long-term returns. Just ask Warren Buffet.

Let’s take a real-life example of buy-and-hold investing.

Say you purchased 500 shares of Tesla stock in 2011 at a price of $2.00 per share (yes, that was the split-adjusted price back then). Even though the price dropped to $1.51 in 2012, you continued to hold onto it. If you are a buy and hold investor, you still have those shares today, which are worth about $180 each.

In this example, your 500 shares and $1,000 investment are now worth $90,000!

On the other hand, if you decided to cut your losses and sell your 500 shares in 2012 when the Tesla stock price dropped down to $1.50 per share, you would have definitely lost $250 AND you would have missed out on it’s amazing rise over the last decade.

If you were a Motley Fool Rule Breakers subscriber in 2011, you would now be $79,000 richer because they picked Tesla back then. They also re-recommended it in 2013 when it was at $35.

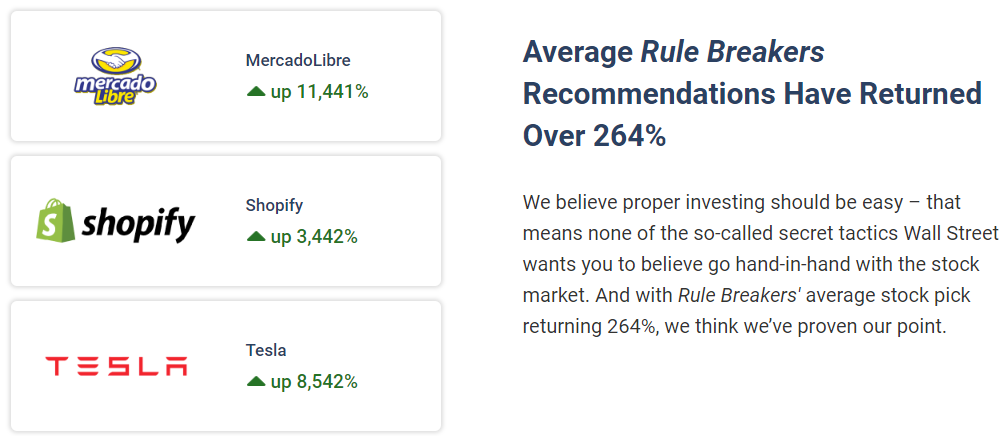

This is exactly what Rule Breakers is all about, finding stocks that are set to be market leaders in developing industries. Other 1,000+% Rule Breakers picks include MercadoLibre, Shopify, Google, Salesforce, Intuitive Surgical, Chipotle, AXON, TTD, and many more.

When you buy-and-hold, you are trusting that you picked solid stocks and that you will receive substantial appreciation in the future. Do you see the importance of buy-and-hold strategies yet (no offense to the day traders with us today – we love you too)?

But, if you are onboard…

…I have uncovered an excellent way to maximize the returns on your investments.

About the Motley Fool

The Motley Fool is a significant player in the financial media space. The brother duo of Tom and David Gardner founded the company back in 1993.

Today, over 30 glorious years later, the company employs over 300 people and 500,000 subscribers.

The Motley Fool provides a mix of free and premium services for stock news and analysis. You can access investment news, research, and guides on the main website (www.fool.com). The Motley Fool cuts out the fluff and focuses solely on investment advice.

Outside of the free main website, Motley Fool offers two paid newsletters. The newsletters are Motley Fool Stock Advisor and Rule Breakers. Both newsletters provide investment advice to increase your investment returns. However, each newsletter focuses on a different type of stock investment.

The Motley Fool Rule Breakers newsletter focuses more on high-growth stocks in emerging or relatively new markets.

The Motley Fool Stock Advisor service focuses more on growth stocks in established markets with lower volatility.

Today, we are here to talk about the Motley Fool Rule Breakers newsletter.

But don’t worry – we will compare both newsletters further down the page.

So, are you ready to get started?

What Are Growth Stocks?

The Motley Fool Rule Breakers is a newsletter for the “high-growth” investor.

But what do we mean by “high-growth” stocks? Growth stocks are mainly companies selling more goods and services each year, typically in a new or growing industry. However, you cannot look at growth rates as a standalone reason for choosing a stock.

Instead, the Motley Fool Rule Breakers service looks at companies likely to turn a high-growth rate into sustainable, long-term cash flow.

And the payoff for growth investors can be HUGE.

Now that you know a little about growth stocks…

…what really constitutes a high-growth stock?

According to the website, the Rule Breakers newsletter “focuses primarily on under-appreciated growth stocks with solid management and a sustainable business strategy.”

One of the most critical pieces of a Rule Breakers stock is that each company meets the two following criteria:

- The company is an innovator

- The company operates in an emerging industry

However, these are just two criteria for being a “Rule Breaker.”

We will get into the other “rules” to becoming a Rule Breakers stock shortly.

What Makes a Rule Breakers Stock?

It is no secret that Motley Fool Rule Breakers go after specific stocks.

You can read about the six rules that break all the other rules.

Rule #1: The company must be a “top dog” in an growing industry

As Motley Fool states, “It doesn’t matter if you’re the big player in floppy drives — the industry is falling apart.”

However, on the other side, you can be in a great industry, but be too small to realize your growth potential.

To follow this rule, David seeks innovative companies that are leaders in an emerging industry.

Rule #2: The company must have a sustainable advantage

Whether the advantages are through…

- Business momentum

- Patent protection

- Visionary leadership

- Inept competitors

…a Rule Breaker must have the edge over other competitors.

These advantages will keep each company stacking gains for years to come.

Rule #3: The company must have strong past price appreciation

You know what they say about the best growth stocks…

…they tend to keep growing!

Therefore, each Rule Breakers stock is a proven winner in the market.

Rule #4: The company must have proper management and smart backing

Name one company with incompetent management that maintains success.

Go ahead – I will wait.

Can’t think of any?

This is why David seeks only the best of the best.

Rule #5: The company must have strong consumer appeal.

The most successful companies have a strong customer base.

That is a dead giveaway, right?

Well, giveaway or not, it is a rule to become a Rule Breaker.

Rule #6: The financial media is overvaluing the company.

Rule Breakers are simply “too expensive,” according to the financial press.

However, these “experts” may be overlooking a company’s transformative value.

Rule Breakers do not overlook transformative value.

What Do You Get with Rule Breakers?

Let’s kick-off the Motley Fool Rule Breakers review with what you get with this service. Okay, now that you know about the Fool’s proprietary stock-identifying system it’s time to reveal what you get with your Rule Breakers subscription.

The price of admission (retail price is $299 per year) includes the following features:

Two new stock picks each month

David Gardner and his team go through thousands of stocks each month.

The result? You receive two of David’s best recommendations delivered to your inbox (generally on the 2nd and 4th Thursday of each month).

These Rule Breakers stock picks follow the criteria mentioned above.

Ten Timely Buys

When you sign up for Motley Fool Rule Breakers, you’ll get a list of 10 timely buys based on Motley Fool’s research.

This is an upgrade from what they used to offer, which was a list of five “Best Buys Now.”

Motley Fool chooses the 10 best stocks to buy right now from a list of more than 200, based on their Rule Breakers criteria.

Rule Breakers Starter Stocks

So, with Rule Breakers you get 2 brand news picks a month, or 24 a year. They frequently re-recommend stocks, and they end up selling almost 50% of them over time.

Instead of buying all the recommended stocks, I suggest checking out the “Starter Stocks.”

Motley Fool believes that these stocks are the best in the Rule Breakers portfolio.

Many have experienced exponential growth, including the three in the image above.

This list is updated regularly to reflect each stock’s performance and potential.

As a rule of thumb, Motley Fool suggests buying at least three starter stocks (with a total of fifteen stocks in your portfolio).

From there, you can begin to include more volatile stocks recommended by Rule Breakers.

Community and Investing Resources

Each stock idea comes with an extensive research report.

The report lays out, step-by-step, the opportunity and risks associated with the investment.

You’ll also get access to ideas and opinions from the Motley Fool community.

So How Much is a Subscription to the Fool's Rule Breaker service?

The Rule Breaker service is usually $299 a year, but there is a special sales page for new subscribers. They frequently run special promotions like "50% OFF" and "TRY IT FOR JUST $39." So if you are a new subscriber, click THIS LINK and you can try it for just $39 and see their latest sales promotion.

And, there is a 30 day cancellation period for a full refund.

Rule Breakers Performance

As part of the Motley Fool Rule Breakers review…

…we are going to assess the service’s past performance.

First of all, you need to know that I have been a subscriber since January 2016. I also opened up a brand new ETrade account at that time and I have purchased roughly $2,000 of each and every one of their stock recommendations.

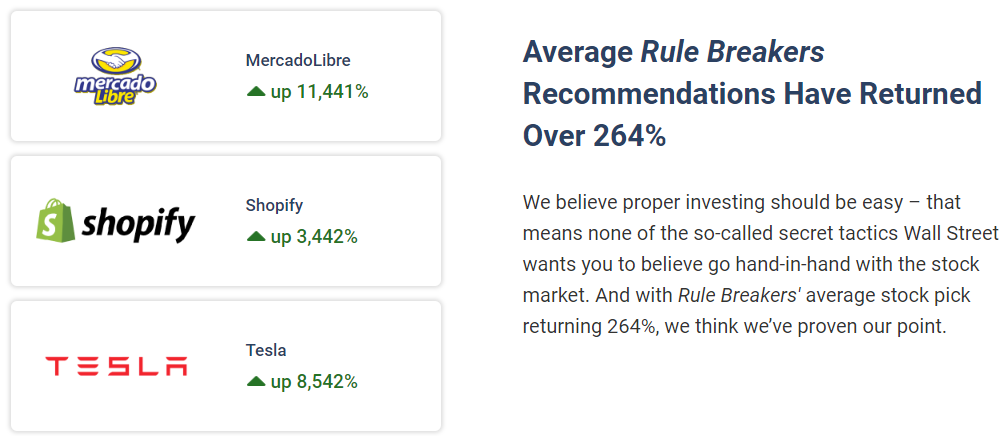

As of March 24, 2024, here are the results of Rule Breakers and Stock Advisor picks since I have been tracking them beginning in 2016:

As you can see, the Motley Fool Rule Breakers stock picks that I bought have absolutely CRUSHED the market and are outperforming the more popular Motley Fool Stock Advisor service.

Based on my experience over the last 8 years, it is absolutely worth it! Normally the price is $299 a year but for a limited time, you can get the next 24 Rule Breakers stock picks for just $99 per year!

If you want to see more detail, take a look at some of these picks from the last few years as of May 4, 2024 prices…

- November, 2023 pick NU up 44%

- October, 2023 pick CAVA up 112%

- October, 2023 pick SWAV up 54%

- June, 2023 pick IOT up 48%

- April, 2023 pick DUOL up 71%

- March, 2023 pick PUBM up 68%

- February, 2023 pick SG up 136%

- February, 2023 pick CRWD up 171%

- December, 2022 pick MNDY up 63%

- December, 2022 pick BRZE up 57%

- October, 2022 pick CELH up 155%

- October, 2022 pick HUBS up 126%

- and July, 2022 pick UBER up 235%

They achieve these fantastic results because they really do pick a few stocks that double or triple each year, and that makes up for the few losers that they do pick.

Remember, normally the price is $299 a year but for a short time, you can get the next 24 Rule Breakers stock picks for just $99 per year! New subscribers only; 30 day money back guarantee.

You should note that these are the better results of Rule Breakers.

Historically, the gains have offset any past losses.

For example, let’s say you buy a recommendation that loses 20% in 2024.

However, you choose another stock that triples in value (300%) by the end of 2024.

In this instance, you come out far ahead of your “bad” investment.

Just like anything in life, you are taking a risk.

What we love about Rule Breakers is that the company is historically very successful.

Rule Breakers Layout

If you are familiar with the Motley Fool Stock Advisor service, Rule Breakers is very similar.

So, what’s good about Rule Breakers?

The platform is user-friendly and intuitive.

To begin, navigate to the “Home” tab.

The “Home” tab includes all updates and active stock recommendations.

You can also see the overall performance, upcoming stock pick schedules, articles, and more.

If you want to learn more about any particular stock, simply click on the stock logo.

Under each stock logo, you can access the analysis section.

The analysis section includes the underlying fundamentals, ratios, charts, and more information.

You also have the option to receive notifications for any stock that Rule Breakers recommends.

From here, you can move on to the “My Favorites” page.

Under “My Favorites,” you can track stocks of personal interest.

Additionally, you will receive alerts on Buy and Sell recommendations and significant price fluctuations.

Do these features sound familiar?

If so, you are likely a subscriber of the Motley Fool Stock Advisor service.

Next up is the “Performance” page.

The “Performance” page displays the results of all Rule Breakers recommendations.

And these results go all the way back to 2004.

Last but not least, you can view each stock by rating.

The stock ratings are based on risk and how the Rule Breakers measure risk.

Is Rule Breakers Worth the Money?

This Motley Fool Rule Breakers review is not complete without answering…

…is Rule Breakers worth the money?

More importantly, is Motley Fool Rule Breakers worth YOUR money?

Did you know…

…Motley Fool Rule Breakers retails at $299 per year!

But, for a short time, you can get Rule Breakers for just $99 per year! New subscribers only.

However, if you are not ready to spend a dime, you can take advantage of Rule Breakers’ 30-day money-back guarantee.

The free trial provides full access to the entire website.

So, is Motley Fool Rule Breakers worth the money?

In the world of investing, “value” is determined by two things:

- The price of the service

- The impact the service has on your investments

Therefore, “cheap” does not always equal cheap (and vice versa).

For example, you may save money with a cheap service…

…but what does that mean for your portfolio?!

Rule Breakers provides the best of value and quality.

At just $99 annually, it is hard to find a more cost-effective service.

Furthermore, it is hard to find the quality of advice on other investment services (which are always more expensive).

We conclude that Motley Fool Rule Breakers is well-worth the money.

You can easily make back your $99 investment with one good stock buy.

Motley Fool Rule Breakers vs. Stock Advisor

So, this can’t possibly just be a Motley Fool Rule Breakers review…

…because you also need to know about Motley Fool Stock Advisor.

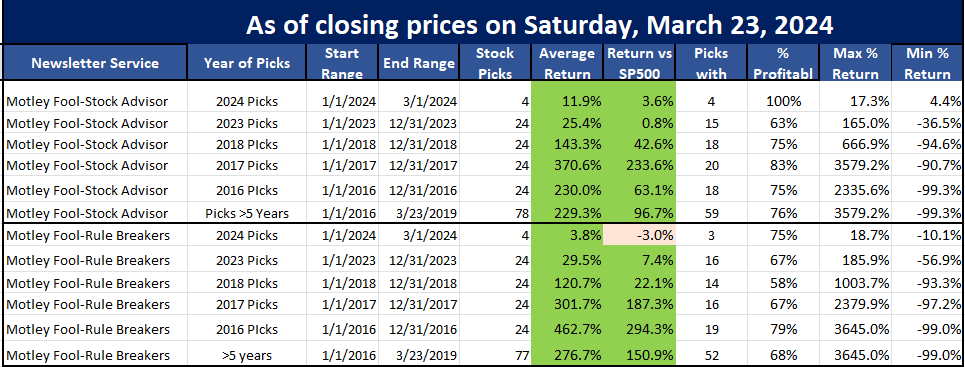

One of the primary goals of Motley Fool newsletters is to beat the market with their stock picks.

To that end, these investment pros offer two newsletters:

- Motley Fool Rule Breakers (I am concerned if you are not aware by now)

- Motley Fool Stock Advisor

The platform of these two services is very similar.

Each stock picking service consistently beats the market.

However, the difference between the two lies in the investing methodologies.

Rule Breakers picks are geared toward growth investors.

The Motley Fool Stock Advisor is geared toward less volatile investments.

But the goal of each service is to uncover stocks that are overlooked by Wall Street.

For this reason, both services make a compelling case for your consideration.

Perhaps you want to know which stock picking service performs better.

I showed you my portfolio, but what does Motley Fool say about the results of its stock picks?

Overall, Rule Breakers stock picks are outperforming the S&P 500 by 264%. But what about the Motley Fool Stock Advisor?

We can’t forget this isn’t a true “apples-to-apples” comparison, since Rule Breakers stock picks are more risky than Stock Advisor’s stock picks.

Overall, both sets of stock picks have experienced impressive growth.

The Motley Fool Stock Advisor has outperformed the market by a higher percentage.

Assuming you buy all recommendations from both services, you would do better with the Motley Fool Stock Advisor.

So, which service is the best fit for you?

That is for you to decide.

Fortunately, you can try both services for free.

That is right – Rule Breakers and the Motley Fool Stock Advisor offers a 30-day, 100% money-back guarantee.

So How Much is a Subscription to the Fool's Rule Breaker service?

The Rule Breaker service is usually $299 a year, but there is a special sales page for new subscribers. They frequently run special promotions like "50% OFF" and "TRY IT FOR JUST $39." So if you are a new subscriber, click THIS LINK and you can try it for just $39 and see their latest sales promotion.

And, there is a 30 day cancellation period for a full refund.

Who Should Use Rule Breakers?

With the Rule Breakers service, you will win some, and you will lose some.

The service is trying to predict the next “big thing.”

Therefore, this strategy comes with significant volatility (unless you can predict the future).

For this reason, I recommend using this service if you have an established portfolio.

If you are brand-new to investing, you need a solid base before speculating on individual stocks.

For those with an established portfolio, the Motley Fool’s Rule Breakers service is excellent if you can bear the additional risk and want to boost your gains.

However, I suggest allocating a small percentage of your overall portfolio to buy these stocks.

Additionally, Rule Breakers stocks are primarily for long-term investors.

If you are seeking a quick dollar…

…Rule Breakers is not for you!

If you are looking for a service that will tell you when to buy, at what price, and when to sell…

…again, Rule Breakers is not for you!

Finally, if you are not able to withstand short-term drops in stock price…

…Rule Breakers is not for you!

I am only telling you this because I want you to be successful.

So, who can be successful with Rule Breakers?

Let me tell you the ideal candidate for the Motley Fool’s Rule Breakers service:

- An investor that is looking for high-quality, long-term investment ideas.

- An investor that is looking for an online community of investors.

And remember, Rule Breakers has historically more than doubled the S&P 500s returns.

Therefore, if you are savvy enough, you can improve upon the Rule Breakers performance by performing your own analysis on each recommendation.

In case you forgot, you can try Rule Breakers risk-free with their money-back guarantee.

So How Much is a Subscription to the Fool's Rule Breaker service?

The Rule Breaker service is usually $299 a year, but there is a special sales page for new subscribers. They frequently run special promotions like "50% OFF" and "TRY IT FOR JUST $39." So if you are a new subscriber, click THIS LINK and you can try it for just $39 and see their latest sales promotion.

And, there is a 30 day cancellation period for a full refund.

Final Thoughts

And that is our Motley Fool Rule Breakers Review.

So, now you know ALL of the facts regarding Rule Breakers.

The bottom-line?

Motley Fool Rule Breakers is an excellent service to complement your investing.

My favorite thing about Rule Breakers is transparency.

David Gardner and his team make recommendations and show you the results (forever).

This company does not sweep bad recommendations under the rug.

Instead, Rule Breakers embraces the inherent risk in the market and shows that even the experts cannot be 100% accurate.

Fortunately, David and the team are so successful that the total results (gains and losses) generate plenty of new customers.

Why?

Because overall, Rule Breakers is winning!

However, this service should not be your sole resource.

But Rule Breakers can expose you to investment ideas you never imagined.

These ideas can include different investments, industries, or companies.

So, apart from making money, you stand to learn plenty of new information.

You can learn from the online community of investors, too.

The forums contain endless information and expert-level analysis from experienced investors.

Therefore, investors of all experience levels can learn something here (even David Gardner himself).

In addition to knowledgeable, the forums are full of friendly and supportive users.

You may even get lucky enough for David Gardner to respond to your question.

The other Rule Breakers analysts spend plenty of time on the forum, as well.

With all that Rule Breakers can offer…

…why have you not signed up already?

It is time to take control of your financial future TODAY!

Do you have experience with the Motley Fool?

Click Here To Get Rule Breakers For Only $39/month or $99/year

Do you recommend another investment newsletter?

Let us know with a comment below!

CLICK HERE to save $200.

Deal or No Deal

Deal or No Deal Real-Time Rankings Are Here!

Real-Time Rankings Are Here! Broadening Bottom

Broadening Bottom