Definition:

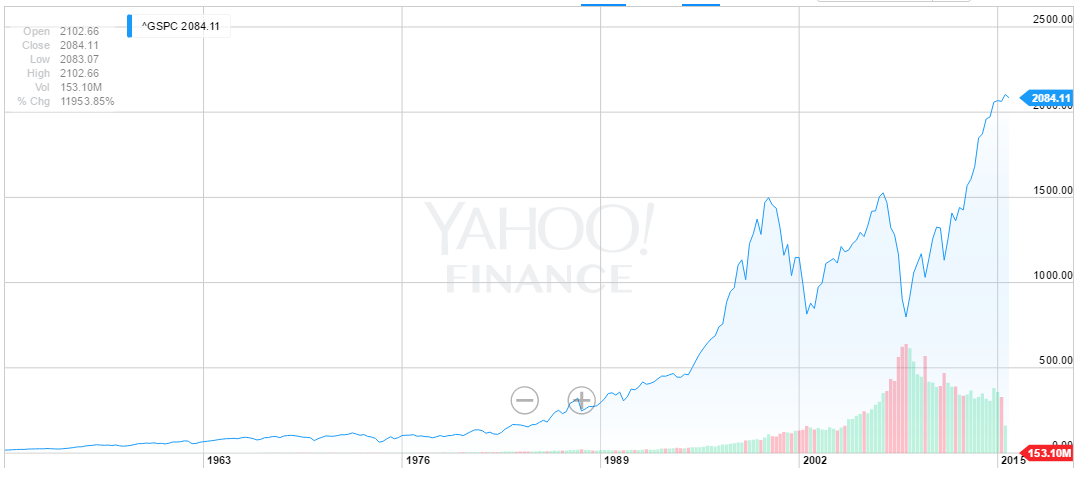

The S&P 500 is currently the most followed stock index in the world. It works like a model portfolio holding stocks in 500 of the biggest, and most traded, companies in the United States, diversified across all 10 major sectors of the US economy. It is usually considered the benchmark against which other investments are compared; “beating the market” usually means to have better returns than the S&P 500.

If you wanted to match the S&P 500’s returns, it would be very difficult to buy into all 500 companies; even one share of each would cost nearly a hundred thousand dollars. However, the [htmwquote]SPY[/htmwquote] ETF can be used instead; this ETF aims to match the S&P 500 index and provide comparable returns to investors.

History:

The S&P 500 index is produced by Standard & Poor’s, a ratings agency that has been active since 1860. During the early days of Wall Street, they released their first index of stocks, the S&P 90, which was designed to compete with the Dow Jones Industrial Average, another index of 30 of the country’s biggest companies. Over time, they also began to publish weekly reports with over 400 stocks. By 1957 their “big list” became so popular that they morphed their original, smaller index to include 500 stocks, becoming the index we now all know and love.

REITs

REITs What is the New York Stock Exchange?

What is the New York Stock Exchange? Fundamentals of Marketing

Fundamentals of Marketing