Good Till Date Order Terms

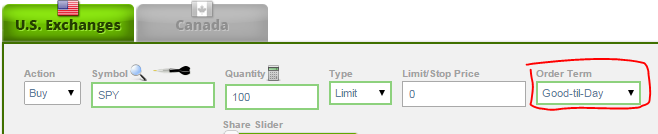

If you have ever placed a limit or stop order on HowTheMarketWorks, you have see the “Good Till Day” order term on the trading menu:

A “Good-Till-Day” order is simply one that will cancel at the end of the trading day if it does not fill. So, for example, if you have Apple stock, and today you know they are releasing an Earnings Release, you know their price is probably going to change quite a bit today.

If you are worried about losing value, but don’t want to stare at the ticker all day, you can put a Sell Stop order at the price you would want to dump it at if the price starts falling, and set the order to cancel at the end of today.

If the price does start falling, the order will execute as soon as it hits your price threshold. If the price doesn’t fall, the order will cancel at the end of the day.

If you place a Good Till Day order after the market has closed, it will stay open until the end of the next trading day.

Why Use It?

Many people use Good Till Cancel orders, will will stay open until either they execute, or they cancel the order manually. One disadvantage to this is that you cannot execute a Market Order on stock you have an outstanding Limit Order on; this means that if you have a Stop order placed on your Apple stock, but the price goes up and you want to sell it, you would first have to cancel your Stop order before you can make a Sell market order.

Generally, people put Good Till Day orders on many Limit Orders for stocks they are hoping have a big spike during the day, and stop orders when they fear some market news may come out that will cause a long-term decrease in a stocks price.

Videos Page Update!

Videos Page Update! Maintenance Margin

Maintenance Margin