What are Credit Cards?

Credit cards is a form of unsecured credit (meaning a loan without collateral) that you can use to make everyday purchases. All credit card purchases are made using a loan – you borrow money from your credit card issuer, and later pay it back with interest.

Credit Cards Vs Debit Cards

Credit cards can be used at all the same places as debit cards. In fact, some business only take credit cards (like most car rental companies and many hotels) specifically because it works as a line of credit – a business accepting a transaction from a credit card knows it will be paid immediately. If you have both a debit card and a credit card, you should choose carefully which you use most for your everyday transactions.

Advantages over Debit Cards

There are some good reasons to use credit cards for every-day purchases instead of your debit card:

- Your debit card may have a transaction limit or transaction fees – credit cards typically do not

- Credit cards often offer “Cash back” and other rewards programs for most purchases

- Credit cards are accepted more widely than debit cards (especially if you are travelling overseas)

- Using your credit card will build your credit history, which can lower your interest rate and increase your credit limit on other loans

- You can “Float” credit card purchases, using it as a short-term loan before your next paycheck

Disadvantages over Debit Cards

There are also some good reasons to use your debit card instead of a credit card:

- If you miss your grace period, your purchases will be charged interest with a credit card, making them more expensive

- Since you do not need to pay the full balance on credit card purchases every month, it makes it easier to over-spend

- If you start to fall behind on your payments, it can be very difficult to fully escape credit card debt

- Credit card billing cycles are usually 20-25 days instead of one month, making it more difficult to schedule payments compared to other types of bills.

Credit Balance Types

When you use your credit card, there are several different types of balances that will appear on your credit card statement:

New Purchases

Your new purchases are the things you’ve bought using your credit card during the current billing cycle. You will not be charged interest on this balance until the end of your grace period, so it is usually a good idea to pay off this balance first and avoid finance fees. If you miss your grace period, you will be charged interest on the balance for every day you had it.

Balance Transfers

If you don’t pay off all your purchases in a month, the remaining balance will carry over to the next month as a Balance Transfer. Balance transfers do not have a grace period, so they will accumulate interest for the entire billing cycle.

Cash Advances

This is the most expensive type of charge you can make on your credit card. Cash advances are when you take money out of an ATM using your credit card. Cash advances also typically do not have a grace period, and they usually have a higher interest rate than balance transfers.

Finance Charges and Interest Rates

Credit card companies have finance charges as a condition to using the credit card – the most important one is your interest rate. Each one of your balance types has a different way interest is charged

How Interest is Calculated

Different credit cards may calculate the interest you owe differently, and this difference might make a big difference on your bill. The two most common methods are “Daily Balance” and “Average Daily Balance”.

Previous Balance

The previous balance method uses your balance at the beginning of the billing cycle to calculate your interest. This means that payments you make during the billing cycle will not lower your total interest payment, but will only impact your bill next month.

Adjusted Balance

This method is similar to the previous balance, but also subtracts any payments you make. This method gets you the lowest total interest charges, but is very rare for credit card companies to offer it.

Ending Balance

The ending balance adds your balance transfer to all the charges you made during this billing cycle, and subtracts any payments you made. The interest is then calculated based on that final total.

Average Daily Balance

This method is the most common. Your credit card company takes the average balance of all days and multiplies that by your daily interest rate, then adds it together for every day in the billing cycle.

Grace Period

Every credit card has a grace period, usually about 21 days. If you pay off any new purchases within 21 days of making them, you will not get an interest charge for those purchases. If you miss the grace period, you will be charged the full interest amount. There is no grace period for balance transfers and cash advances, so you will be charged for every day you have a balance outstanding on these balances.

Minimum Payments

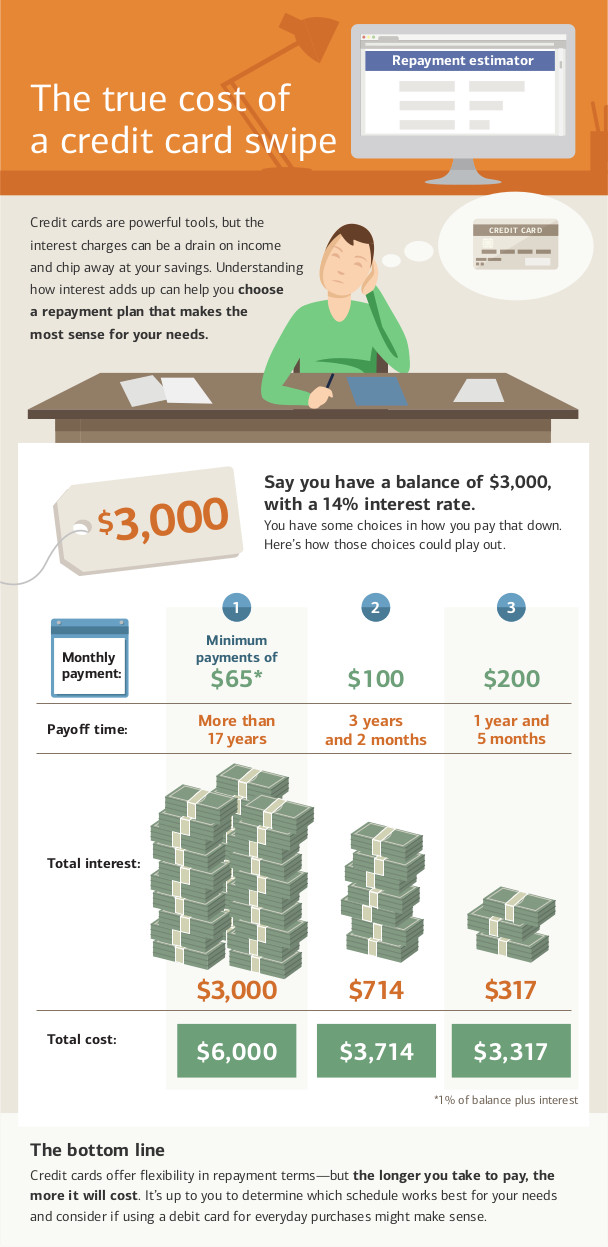

Your credit card will have a minimum payment every month, which is the absolute least you can pay to keep your account in good standing. Your minimum payment is based on your outstanding balance. The payment is generally enough to pay off new interest, plus some of the principle balance.

Just making the minimum payments is the absolute longest way to pay off credit card debt, and it will result in the absolute highest possible amount you pay in interest.

Note that there are some conditions that can cause your minimum payment to be less than interest, in which case you will never fully pay off the debt. If your minimum payment is lower than or equal to your interest charge, you can continue making payments on interest forever without ever paying off your debt.

Missing Payments

Missing your credit card payments can result in defaulting on your account. Defaulting on your account has a few impacts:

- If you had any promotional interest rate, you will retroactively lose it (meaning all your previous outstanding balances will now use the higher interest rate instead of the promotional rate, making your bill even higher)

- You will get “Late Payment” fees, which is added to your balance transfer into the next billing cycle

- Missed payments are reported to the credit reporting agencies and will lower your credit score

- Your credit card may also lower your credit limit and increase your interest rate

If you miss a certain number of payments, your credit card may cancel your line of credit entirely, and send your case to a collections agency. This will further damage your credit score, and make it extremely difficult to get any new credit cards or loans for the next several years.

The CARD Act of 2009

In 2009, the federal government passed the Credit Card Accountability, Responsibility, and Disclosure Act of 2009, which bans certain types of behavior from credit card companies. It also gives credit card holders more tools to help keep their credit cards in good standing.

The CARD act bans credit card companies from:

- Increasing your interest rate on existing balances (so if your rate goes up, it only applies to new purchases). This doesn’t apply to removing promotional rates

- Your interest rate cannot go up in the first year of holding your account (except if you have a variable rate credit card, then your base rate can’t do up but the variable rate can)

- Processing your payments late (all payments must be processed on the day they are received)

- Charging fees for different methods of payment

- Using a double billing cycle (where you would be charged interest based on the last period’s balances instead of just the current period)

- Issue credit cards to people under 21 without a co-signer

As the card holder, you also get new rights with your credit card:

- If you default on one credit card, credit card companies can’t automatically charge you a higher “penalty rate” on other cards you have

- You have at least 21 days after your bill is mailed to pay it without any interest charge

- If you pay more than the minimum payment, all the extra is paid towards your balance with the highest interest charges first (so if you make higher than the minimum payment, the extra would go towards your cash advances before your balance transfer)

- You can opt-out of over-the-limit fees. If you do, trying to charge more than your credit limit would result in a declined transaction instead of letting it go through with a fee

- You can opt-out of interest rate increases. If you do, your credit card will be cancelled once you pay off your balance (this might impact your credit score).

TDAmeritrade® Trading Platform

TDAmeritrade® Trading Platform