Trading, investing, and saving requires skills. There is no doubt that the complexity of the financial markets warrants an in-depth understanding of the interrelatedness between multiple variables. Consider inflation, employment, and interest rates as cases in point. These macroeconomic elements have a substantial impact on stocks, bonds, mutual funds, ETFs, currencies, commodities, and indices trading. Even with a tertiary education in economics and strategic management, it’s no mean feat to dabble in the financial markets and stay afloat.

Stocks are inherently volatile. They are associated with peaks and troughs, cycles and patterns. Traders and investors are best served by conducting in-depth analysis of these securities before putting hard-earned money into a company’s stock. The performance of stocks is affected by a myriad of factors, notably consumer confidence, business confidence, the dollar index, the inflation rate, interest rate, fiscal policy, and company performance, et al. But that’s only one side of the equation; multiple other elements impact stock prices and company performance, most of them in a non-linear fashion.

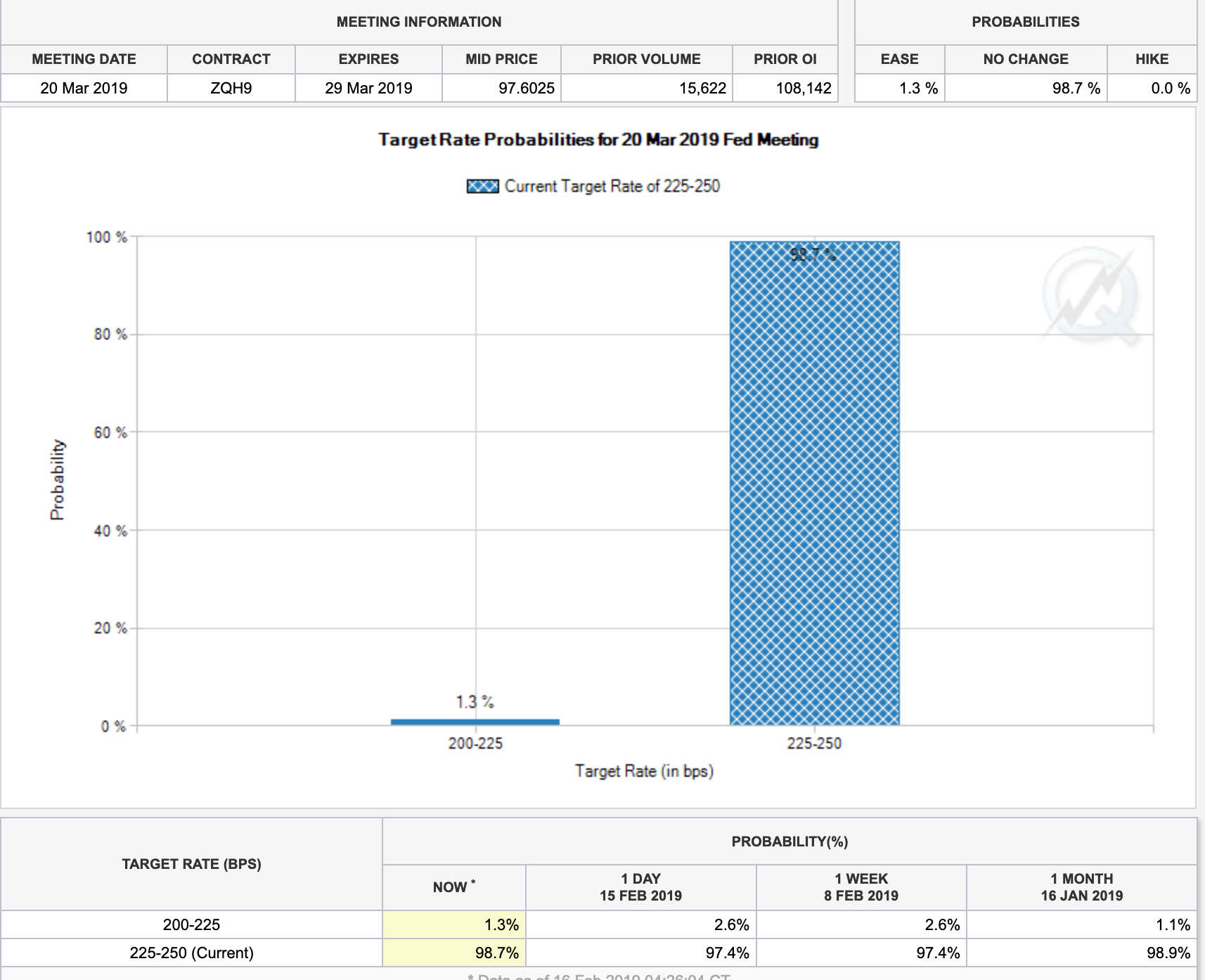

For example, one might expect that an interest-rate hike would encourage foreign investors to acquire more USD. This would naturally boost the strength of the USD which would make US exports relatively more expensive on the global stage, thereby having a negative impact on company sales, performance, and earnings. This should decrease stock prices. From another perspective, interest rates should also lower stock prices by dint of their effect on the cost of borrowed funds. When companies finance their activities through bank loans, the cost of borrowed capital increases. This means that profits are lower and consumers will ultimately be forced to pay for this in the form of higher prices. However, the performance of the US stock markets does not in any way reflect such behavior. Stocks are running rampant.

A classic example is bank stocks. Bank of America (BAC), Wells Fargo, (WFC) and Citibank (CITI) have largely underperformed, even in the face of a booming economy, deregulation of the banking industry, and rising interest rates. This is largely unexpected. However, there are many underlying reasons why bank stocks are underperforming, including management giving away billions of dollars in stock buybacks, weaker products, and weaker fundamentals in the broader market. There is also the issue of the Federal Reserve bank slowing money growth, and the costs of raw materials rapidly rising.

Of course, the everyday investor is not expected to know this information. Many of us chase soundbites when making trading decisions or long-term investment decisions. If the interest rates are rising, surely bank stocks will appreciate? As you can tell, there are simply too many unanswered questions and investors want things simplified.

How to Avoid Poor Investment Choices with Sophisticated Tools & Resources

Nowadays, traders and investors have many powerful tools and resources available to them. The leading trading platforms provide their clients with expert insights, auto invest options, charts, graphs, technical and fundamental analysis. The advent of augmented reality and artificial intelligence systems has created an entirely new investment framework.

Experts at leading trading brokerages have reviewed many of the available resources on the market, and found that one of the most useful tools on the market is a robo-advisor. We put multiple brokerages to the test and ended up shortlisting a handful of trading platforms. By reading this WealthSimple review reveals that this trading brokerage is best suited to using advanced trading tools and resources. It offers cutting-edge innovative features such as automatic portfolio rebalancing and multiple tiers of accounts geared towards investor preferences.

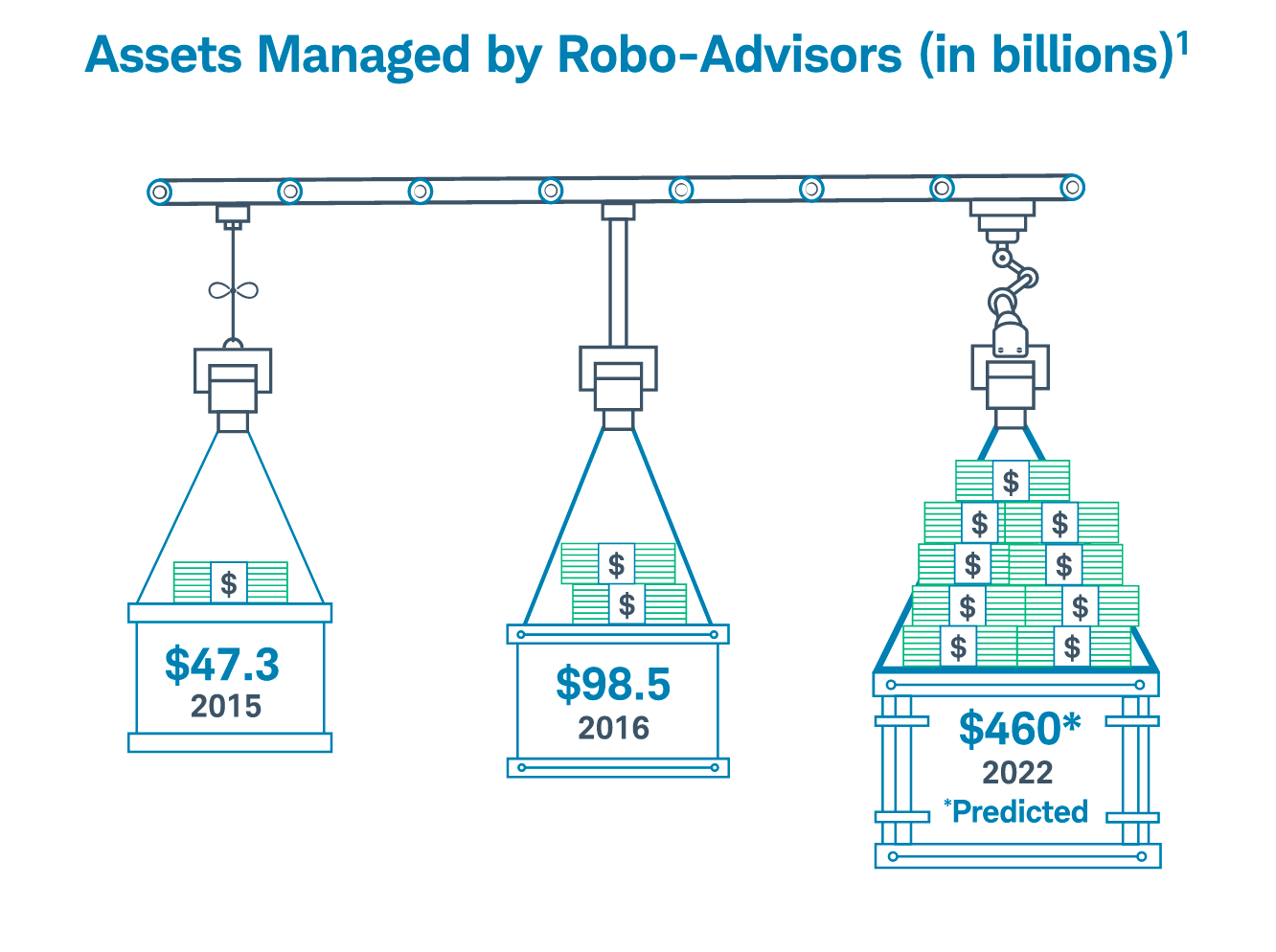

Robo-advisors are algorithmically-based systems which assist investors with their financial portfolios. They are automated platforms which help with savings and investments. You don’t need a human advisor – you can defer to an algorithm. Over the years, significantly more assets have been invested in the financial markets with robo-advisors, including the following past and future projections:

2015 – $47.3 billion

2016 – $98.5 billion

2022 – $460 billion (anticipated)

Assets Under Investment

Source: Charles Schwab & Co

Robo-advisors are designed to help achieve your strategic investment objectives. They do this by delivering a cost-effective solution to clients. Among the many benefits of using a robo-advisor are the following:

- Tax loss harvesting

- Diversified investments

- Zero-emotion investing

- Optimization of asset allocation

- Automatic portfolio rebalancing

- Lower fees (0.25% – 0.5% of the financial portfolio)

The fact that robo-advisors are such a sophisticated tool has led many to question their efficacy for first-time investors. Opinions are divided on the topic of whether a novice investor should employ the services of robo-advisors, or not. Truth be told, a robo-advisor is not capable of offering holistic financial planning for investors. Many important issues such as saving requirements for retirement objectives, defining strategic objectives, and selecting the best types of accounts are not within the general purview of robo-advisors.

There is scant evidence to support the notion that a robo-advisor would be well-suited to calming investor fears if the market collapses. For example, would an algorithm maintain market stability by preventing a mass sell-off of stocks as happened in 2008, or not? On the flip side, they’re accessible at any time – no appointment necessary.

How to get started with a Robo-Advisor?

There are scores of robo-advisors populating the trading and investment arena. Regardless, the steps required to get started are similar:

- Fill out a questionnaire to evaluate your investment requirements

- The robo-advisor suggests a diversified portfolio of ETFs

- The portfolio will be rebalanced by financial experts via an algorithm

- Certain robo-advisors may allow access to financial planners

- Clients can easily track their portfolio progress online

One of the problems that many investors face in the financial markets is that of selling when markets are too low, and buying when markets are too high. This happens when panic sets in and emotional investment decisions are made. The human element cannot truly ever be removed from an investment decision, given that people need assurances about different asset categories, classes, and types. A hybrid system is the most likely solution where a robo-advisor operates in tandem with an investment specialist (when required).

Robo-advisors may well see many investors placing their finances in the bond market if we see interest rates of 5%. This will have an adverse effect on overall client wealth since wealth is largely created in the stock market. The best financial portfolios are the ones which bring multiple asset classes into play. If your financial predicament is relatively simple to gauge, a robo-advisor could be a useful resource.

Wrapping it up with a Robo-Advisor

Overall, there are many different robo-advisor options available, with greater support options available via hybrid systems. Certain companies offering these algorithmic investment resources require minimum account balances of $100,000 + and a 0.4% annual fee for hybrid robo-advisor services. Other robo-advisors allow you to invest as little as $500 or less in your portfolio, and they typically offer between 5 – 10 different ETF options. Besides exchange traded funds, there are also index funds which mirror the performance of an index such as the S&P 500 index, the NASDAQ composite index, and the like.

Most companies offering robo-advisors charge between 0.25% – 0.89% in annual management fees, although the majority of them hover around 0.5%. Fortunately, there aren’t any transaction fees with these services, which is substantially cheaper than investing on your own with companies like Fidelity. If you’re looking to save money on professional investment management services, it is a good idea to consider a robo-advisor which runs on an algorithm designed by investment experts. It is continually monitored according to performance criteria and rebalanced accordingly. Since investors are allowing the algorithm to plough funds into ETFs and not individual stocks, risk is mitigated and performance is broad-based.

France and Germany Signal No More Concessions For Greece!

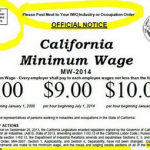

France and Germany Signal No More Concessions For Greece! What is the impact of an increase in minimum wage?

What is the impact of an increase in minimum wage?