Stock index futures are up this morning as investors are starting to see buying opportunities after the big losses last month that stemmed from China’s stock crash and currency unrest around the world. However, investors are beginning to think that the initial sell-off was a bit of an overreaction; stock index futures are used to measure how investors feel the market will move in the near future. As investor confidence goes up, so do index futures, so when we see these kinds of increases we know the market is starting to lean towards growth.

Lots of government reports were also released today; 190,000 jobs were created in the US, although that missed the estimate of 210,000. Long-range Treasury bond yeilds moved slightly higher, but shorter-term bonds stayed the same. This usually means that the bond market thinks equities will be more attractive in the near future, but not much money has been moved from bonds into stocks just yet.

728×90 superawesome

If you want to buy into a stock index, try trading an Index ETF like [htmwquote]SPY[/htmwquote] for the S&P 500, or [htmwquote]QQQ[/htmwquote] for the Dow-Jones Industrial Average! Click Here for more popular Index ETFs that you can trade on HowTheMarketWorks!

HowTheMarketWorksNew – Account Summary Bottom Middle

HowTheMarketWorksNew – Index Bottom Middle

HowTheMarketWorksNew – Quotes Bottom Middle

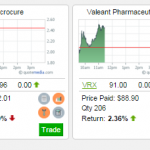

Huge update for your Open Positions!

Huge update for your Open Positions! Stock Index

Stock Index