We support many different order types across the system!

What Is An “Order Type”?

When you want to buy or sell a stock, the prices are always moving; the price now could be very different from the price tomorrow. Most investors are concerned with buying and selling stocks only when they are a certain price, the different “Order Types” are the different instructions you give to your broker when placing a trade on how to act based on the price of a stock, mutual fund, option, or other security.

Market Orders

What does it mean?

Placing a “Market Order” means that you want to buy the stock as soon as possible, at whatever the market price is. For example, if you wanted to buy Google ([htmwquote]GOOG[/htmwquote] stock right now because you think the current price is as low as it will go, you would place a Market Order to try to buy it as soon as you can.

Details

Market orders are what most beginning traders use the most; you see the price, and you want to buy or sell at as close to that price as possible. However, someone still needs to “fill” your order for it to go through; just because you want to buy 50 shares of a stock does not mean that there are 50 people willing to sell them to you. This is especially true for penny stocks, which may trade only a couple times a day, or less.

For a market order, it is also possible for you to get a different price for each individual stock you buy. For example, lets say that the “last price” of a stock you want to buy is $100, and you place a market order for 50 shares.

It could be that there is only 10 shares of that stock for sale left at $100, all the other sellers are trying to sell at $120. This means that the first 10 shares you buy will be $100, and the next 40 will be at $120, giving you an average price of $116!

This will never be a problem for big companies, but if you are trading penny stocks, or any other securities with low volume (especially options), this can become a major concern.

Limit Orders

What does it mean?

A “Limit Order” is when you want to buy or sell something, but only at a “Good” price. You can determine what a “good” price is, both for buying and selling

Details

When you are buying, the limit price specifies the highest price you are willing to pay for that stock; if your limit price is already above the current price, it works like a market order

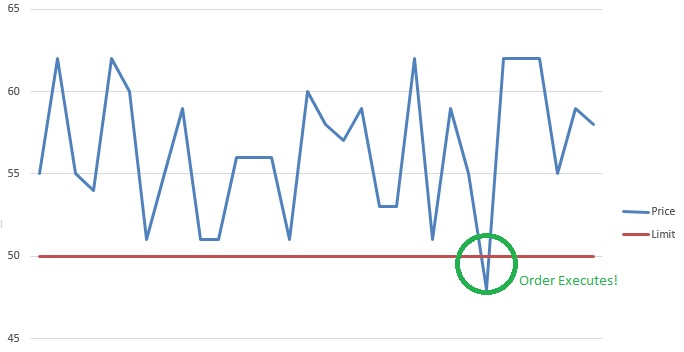

For example, lets say there is a stock you want to buy, its current price is $55. You want to buy it only if the price falls to $50 or below, so you will place a buy-limit order at $50.

Your order will stay open, and if the price falls to $50, it will execute.

For “Sell” orders, it works in the opposite direction: you specific the minimum price you want to sell it at. If the market price goes above that price, your order will execute.

Stop Market Orders (STOP LOSS)

What does it mean?

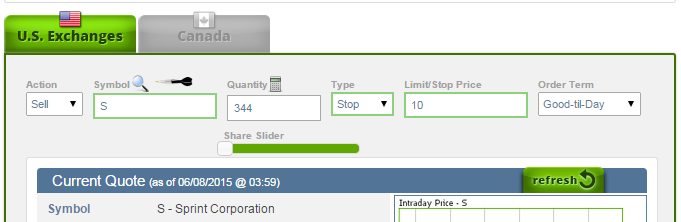

A “Stop” order is when you want to prevent yourself from losing too much money on a position, which is why the are also called “Stop Loss” orders. For buying, you want to make sure you get it before the price goes too high and you miss out, and for selling you want to sell it before the price drops too low and you lose too much money.

Details

Stop orders work the exact opposite of limit orders, you specificy a “Bad” price and your order will execute if the price falls below that.

For buying, you would use a “Stop” order if you are thinking about buying a stock, but don’t want to buy it until the price starts to go up. In this case, you would set a “Stop” order above the market price, and as soon as the market price goes above your stop price, your order will execute.

For selling, it works as a “loss prevention”, you would set your stop price at the point where you want to sell it if the price keeps falling, because you think that if it falls that far, it will continue falling.

Trailing Stop Orders (STOP LOSS)

What does it mean?

Trailing stop orders follow the market; instead of setting a buy stop order at $50, for example, you would set a “Trailing Stop” order to execute as soon as the price goes up by $1.

Details

At first, this might sound like the same as a normal stop or limit order, but its completely different!

For example, lets say you place a “Trailing Stop” buy order for $1, on a stock with a current price of $100.

If the price falls to $95, but then raises back up to $96, your order will execute because the price went up by $1 from its lowest point since you placed your order. If you are making a long-term strategy where you think a stock is falling now, but want to make sure you buy it as soon as the price starts going back up, a trailing stop order is your best friend.

On the other side, you can use a trailing stop Sell order to make sure you automatically sell off your position if the price starts to fall, no matter how high it goes up first. Many investors prefer to use Trailing Stop Sell orders to regular Stop Sell orders so they can be sure they preserve any gains they have made.

Safety Stocks

Safety Stocks