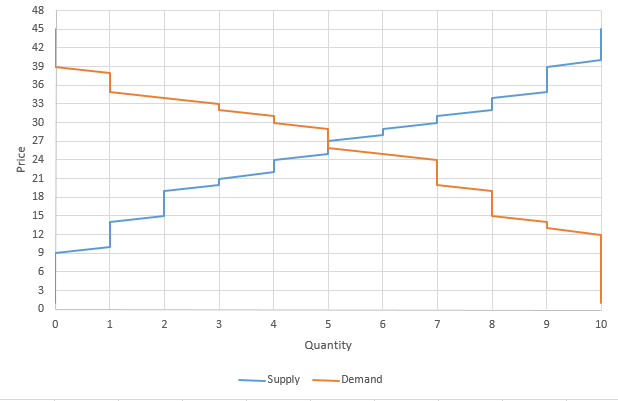

The stock market determines prices by constantly-shifting movements in the supply and demand for stocks. The price and quantity where supply are equal is called “Market Equilibrium”, and one major role of stock exchanges is to help facilitate this balance. We can use the stock market to give some great supply and demand examples with buyers and sellers who want different prices.

Supply of Stock

Click Here for our full article on Supply

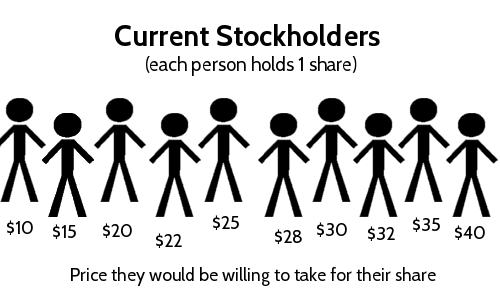

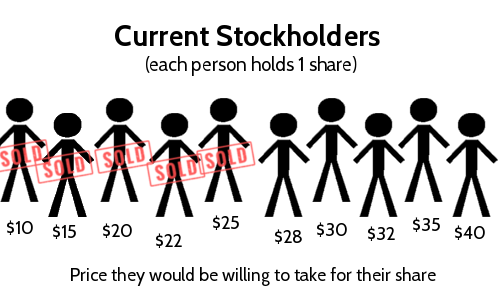

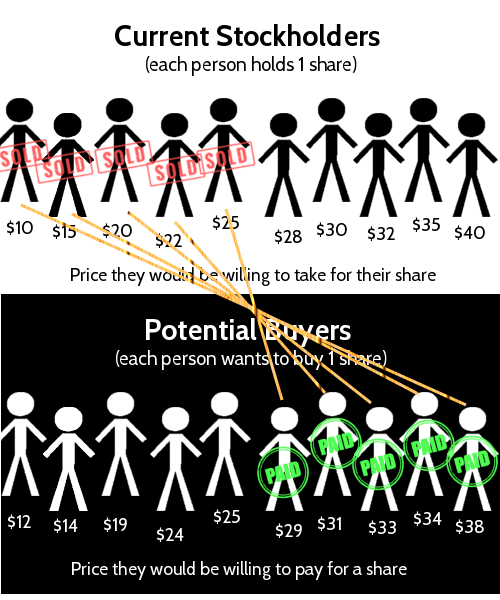

“Supply” refers to the total number of stock holders who would be willing to sell their shares at any price. For example, lets say we have 10 shareholders, each of which would be willing to sell their share at a certain price:

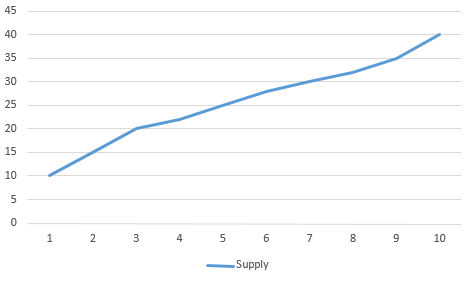

All these sellers “value” their share differently. The shareholders on the left would be willing to take a much lower price for their shares than the sellers on the right. If we look at the whole market for shares, as the price goes up, the total number of shares “supplied” also goes up:

At a market price of $10, only 1 share will be supplied, but at a price of $25, 5 shares would be supplied.

Demand For Stock

Click Here for our full article on Demand

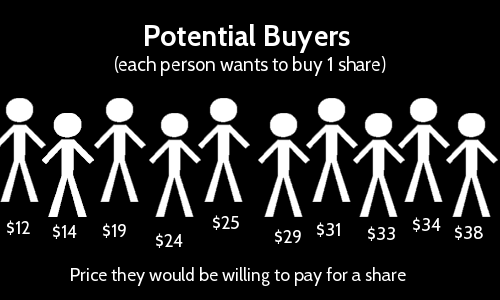

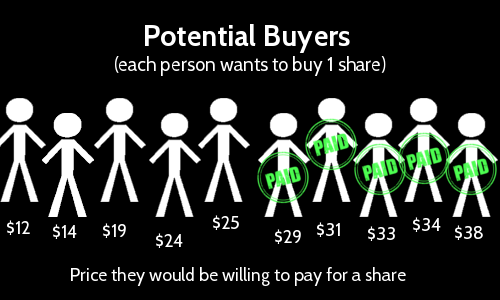

“Demand” refers to the total amount of stock potential buyers would be willing to buy at any price. We can use a similar example to the one above – imagine we have 10 people who want to buy 1 share each, but are only willing to pay a certain price:

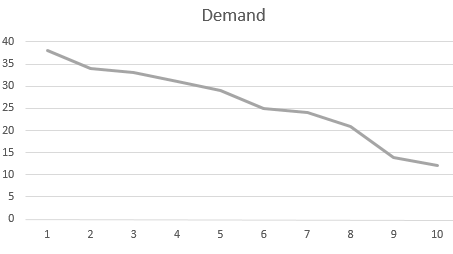

Unlike supply, this means that as the price goes up, fewer people are willing to buy a share. For example, if the price per share was $30, only 4 people would be willing to buy (the 4 on the right side) who would be willing to pay $30 or more). If we look at the total demand as a graph, it slopes downwards:

Market Equilibrium

“Market Equilibrium” is the point where the supply and demand meet – all the potential buyers and sellers trade until there is no-one left who agrees on price. In a graph, you can see the equilibrium point as where the supply and demand meet.

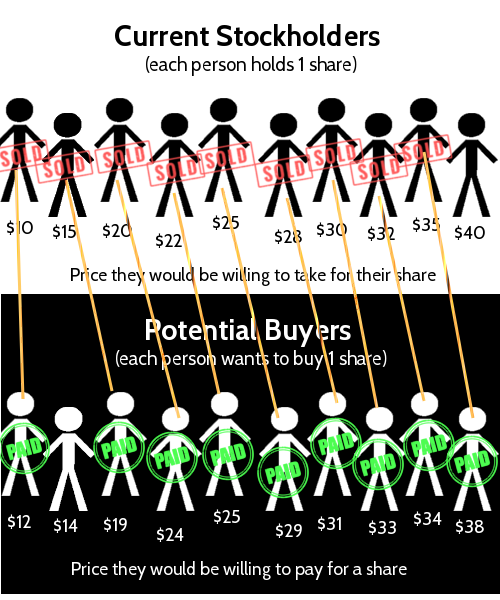

With our example of buyers and sellers, we can see the exact point where the market reaches equilibrium:

At a price of $27 (actually anywhere between $25.50 and $27.50) and a quantity of 5, the supply equals demand and the market is balanced. From a practical standpoint, these are the buyers and sellers who made a trade:

The buyers who wanted the stock the most, and the sellers who were the most eager to get rid of it, made their trade. For the other buyers, no seller was willing to sell their stock low enough for them to want to buy.

The next-lowest seller wants $28 for their stock, but the next-highest buyer will only pay $25, so no more trades will happen.

Efficient Equilibrium

This example makes sense, but why didn’t we have 8 trades instead of 5? If all the highest and lowest buyers and sellers were linked directly, a lot more trades could take place.

Unfortunately, there are some big problems with this. The biggest problem is information: the lowest seller, who sold for somewhere between $10 and $12, can now see that someone else just sold their share for over $35 – all the sellers would only try to sell to the highest buyers, and all the buyers would only try to buy from the lowest sellers.

Producer, Consumer, and Total Surplus

If the potential buyer who is willing to pay $38 wants to make a good deal, they will first try to buy from the person who only wants $10. This way they start with an extra value of $28 – the difference between how much they were willing to pay and how much they actually had to pay. We call this bonus the “Consumer Surplus”:

Consumer Surplus = Highest Price a buyer is willing to pay – Price they actually pay

On the other side, the sellers want to make the most profit they can, so the seller who would take $10 at the minimum would much rather sell to the high buyer for $38, making themselves an extra $28. We call this bonus the “Producer Surplus”:

Producer Surplus = Price a seller actually sells an item for – Lowest price they would sell for

However, we can’t have it both ways. Since the buyer and seller both don’t want to lose out, there will be negotiations and the final sale price will fall somewhere in the middle. In a good system, we will get the maximum amount of these “bonuses” as possible – we want the biggest Total Surplus. We call the pricing and trading system that gives the most total surplus “Efficient”.

Total Surplus = Consumer Surplus + Producer Surplus

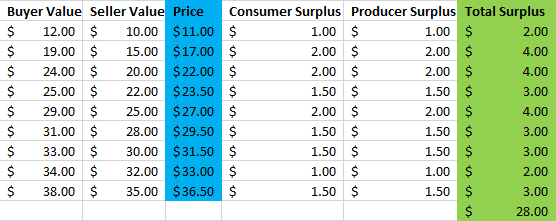

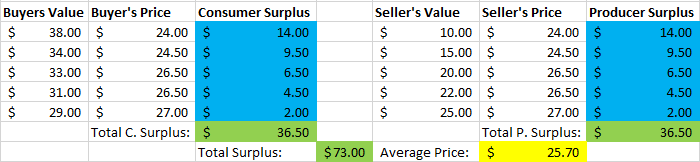

Lets compare the two trading systems – the one where the most number of trades happen (but every trade has a different price) with the one where supply and demand are equal at one price. We will assume that the buyers and sellers in the first system are paying the average of their two prices, and splitting the surplus evenly.

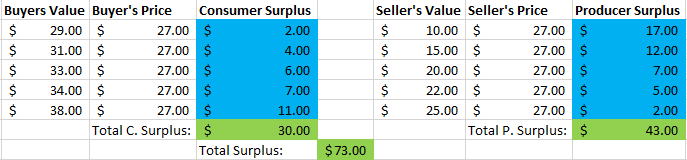

Now let’s compare this to the system where everyone is trading at the same price:

The total surplus under this system is $73 – nearly 3 times as high!

Supply And Demand Examples – Making Trades For The Most Surplus

This might be good for the people who made their trades, but it is also important to see how these prices are found in the first place.

Think of it like all the buyers and sellers are making limit orders – sellers are setting a “Limit Sell” order at their prices, and the buyers are setting “Limit Buy” orders at their prices (Click Here for our full article on Limit Orders).

In the example with the most trades taking place, the stock exchange is taking all the lowest limit buy orders and pairing them with the lowest limit sell orders to make the most trades happen. However, this system can never be fully fair to all the buyers and sellers. Look at the image showing who made their trades in this system – the buyer who would have been willing to pay $14 doesn’t get to buy anything, but the buyer who was willing to pay $12 did. The seller would obviously rather sell to the person offering $14 than the person offering $12 too.

This means that for both one buyer and one seller, a better trade could be made, increasing the Total Surplus, so these buyers and sellers would be better off making their deal outside the stock exchange entirely so they can get a bigger boost.

However, lets go back to our $38 buyer and our $10 seller – both of these would also be better off making a deal with each other outside the stock exchange, since they could settle at a price between their values and have a huge surplus to split with each other. This will happen again with the $15 seller and $34 buyer – they are both making a bigger surplus by buying with each other and abandoning their limit prices entirely. Since the highest buyers and the lowest sellers are pairing off to make their own deals, the lower buyers and the higher sellers no longer have a partner willing to take their price – we arrive back to the same Supply and Demand system where all the trading is done at around the same price as we had for our equilibrium, and with the same Total Surplus.

Supply And Demand Examples – Bid And Ask Prices

This instead makes a system of Bidders and Askers – when you get a quote on HowTheMarketWorks, you’re seeing the most the highest buyer is willing to pay as the Bid Price, and the least a seller is willing to sell for as the Ask Price.

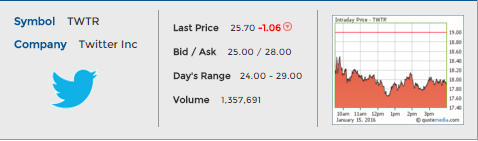

This is an example of a quote for Twitter (symbol: [hq]TWTR[/hq]). There are three prices shown – the Bid Price, the Ask Price, and the Last Price, and this is the exact situation we have already seen with our buyers and sellers above!

The “Last Price” tells us what happened the last time a buyer and seller agreed on a price – they traded at $25.70.

The “Ask Price” tells us how much the next-lowest seller wants for their share – he wants at least $28.00

The “Bid Price” tells us how much the next-highest buyer would be willing to pay for a share – he will pay up to $25.00.

This also impacts you when trading – if you’re trying to buy stock with a “Market Order“, you will get the “Ask Price”, or how much the current sellers want for their stock. If you try to sell with a Market Order, you will get the “Bid Price”, or how much current buyers would be willing to pay for your shares.

AAII.com

AAII.com