Definition:

An order or Stock Order (in finance terms) is to give a broker or brokerage firm instructions to purchase (sell) or short (cover) a security. Traditionally this was done on the phone or even in person directly to the broker or someone under him. Nowadays it is most frequently done online. The orders can vary greatly between choosing market orders, limit orders and stop orders as well as changing how the order will expire.

An order does not mean that you are guaranteed to own (or sell) the stock. It just means that your broker is trying to get it “filled” for you. Filled meaning that they will try and fulfill your stock order. If, for example, you had a buy order, then your broker will be trying to get you the stocks you wanted to buy and thus “fill” or “execute” your trade. Just like in real life, if you try to buy something no one is willing to sell right now you won’t be able to get it and you will have to wait until someone is willing to sell.

Using Orders on HowTheMarketWorks

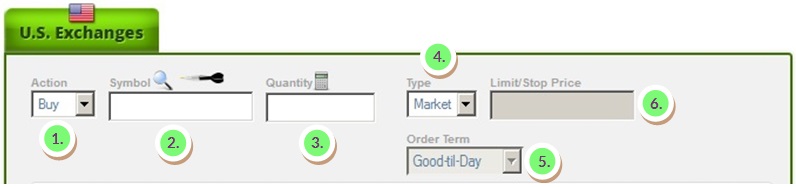

PLACING A STOCK ORDER

Placing an order on HowTheMarketWorks is easy.

- Action: The action will specify whether you are trying to buy, sell, short or cover. You can select this by clicking on the arrow and selecting an item from the drop down menu.

- Symbol: By filling the symbol you will get a quote below. If you don’t know the symbol of the company you are looking for you can click on the magnifying glass. If you don’t know that either, you can click on the dart and will give you some ideas!

- Quantity:This is the number of shares you want. Don’t worry if your not sure! You can see how much it will tell you your estimated cost below and you can use a slider to change the amount you wish to get, or similarly, just delete the number and write a new number.

- Type:This will select the type of order you can select, either a market order, limit order or stop order.

- Order Term:This will select the order term.

Good-til Day will try to execute until the end of the trading day at 4:00 pm ET.

Good-til Cancel will try to execute until you cancel the order. - Limit/Stop Price:This specifies the limit or stop price that you are using to execute your trade. The table below is very useful in determining when a limit or stop will be executed, seeing that there is also enough volume.

!!! Note: Cash is set aside in Withheld Cash until the order executes.

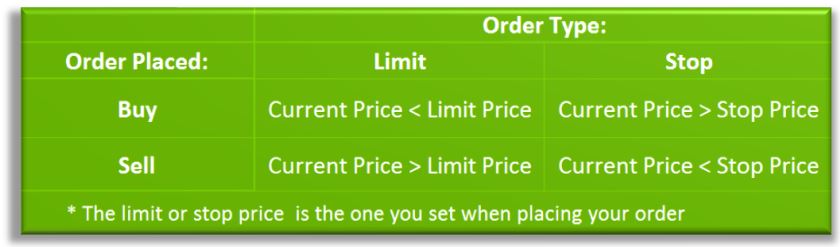

The Stop and limit orders will execute when:

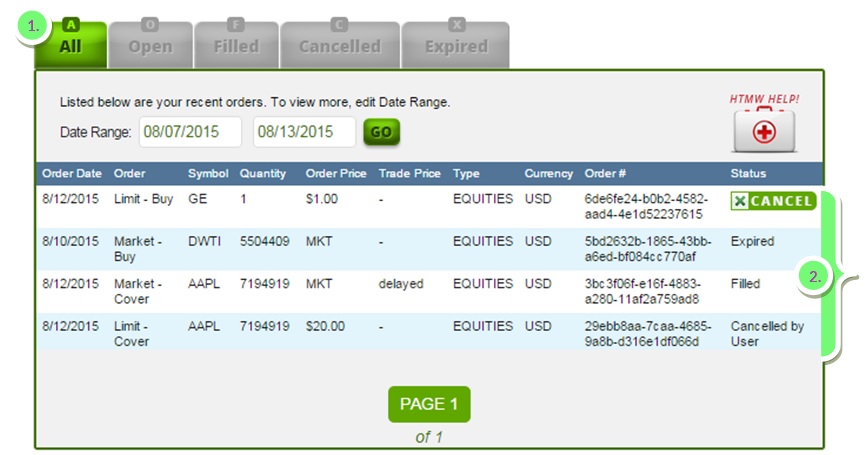

ORDER HISTORY

Orders that are waiting to be executed on the Order History page as well as any expired, filled or cancelled orders.

1. We can see multiple tabs on the page. By selecting the tab in 1. we can order the different types of orders that can be seen in 2.

A – All will show all the orders you’ve created throughout your challenge. If you don’t see any orders and you think you should, don’t forget to check that you have selected the correct contest!

O – Open shows all the orders that are still trying to execute and get filled. Note: every pending order will automatically put the amount of cash you previewed aside while waiting to execute.

F – Filled shows all the orders that have been filled and thus traded successfully.

C – Cancelled shows all the orders that you or the system has cancelled. To cancel an order that is pending simply go to this screen and hit the cancel button in 2. Similarly, if you see system cancelled, it has been cancelled by the system for a variety of different reasons. This could be because the order broke a trading rule or less likely that we made some changes.

X – Expired shows the order’s that expired, usually a market order or good til day order that expired automatically after not filling at the end of the day.

Order Filling – Trade

To have an order successfully go through – these conditions have to be met:

- Volume – There must be enough trading volume for your order to execute. In other words, someone has to buy/sell the shares you sell/buy. The site will uses daily volume so the volume will be higher at the end of day.

- Expiration – The order must be open.

- Limit/Stop – The order must hit the target price you set if you used a limit or stop order.(note:this goes by bid ask, so even if the last price hit your target, the target must hit the appropriate bid or ask.)

- Trading – The stock you are trying to trade must currently be trading.

!!! Note: Mutual Fund orders will always remain open until the end of the day. The trade will only go through at the end of the trading day, between 5:30 pm and 6:30 pm ET.

ETFs vs Stocks

ETFs vs Stocks Personal Finance Tips for New College Graduates

Personal Finance Tips for New College Graduates Preferred Stock

Preferred Stock