The interest rates set by the Federal Reserve Bank have been pegged near zero for many years now, and investors are signalling that they are ready to see it go up. During the financial crisis, interest rates were slashed down to historic low levels as the Fed did everything in its power to ease lending Read More…

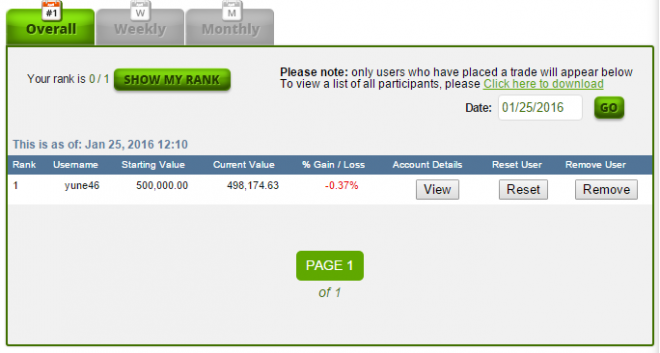

You’ve asked, and we listened! With this most recent update, teachers have more tools than ever to manage their classes on HowTheMarketWorks. You can access all these new tools from the Rankings page when you’re logged in as the contest creator. Next to each user on the page, you have 3 new buttons: “View”, “Reset” Read More…

Times have been changing rather quickly for the alliance between the United States and Saudi Arabia. The main reason is energy. US dependence on Saudi Oil has been dropping rapidly in the last decade, dropping by 50% thanks largely to increased oil production in America (if you want to try trading oil on HowTheMarketWorks, check Read More…

The next 5 days will be a very important learning experience for traders trying to sift through the rubble after China’s highly-publicized currency devaluation and subsequent shockwaves through the world markets. American markets have begun their recovery, with the S&P 500 (ETF: [hq]SPY[/hq]) and Dow-Jones (ETF: [hq]QQQ[/hq]) indecies both recovering some of the losses. However, Read More…

Stock index futures are up this morning as investors are starting to see buying opportunities after the big losses last month that stemmed from China’s stock crash and currency unrest around the world. However, investors are beginning to think that the initial sell-off was a bit of an overreaction; stock index futures are used Read More…

The September Monthly Million Challenge is the first in our Monthly Million series, with over a thousand participants from all over the world! The rankings were fierce, with the HowTheMarketWorks team scattered throughout, but you’ll be surprised who won! The Top 5 performers by portfolio value were: AngelRivera +30.81% Janene+23.14% wkaraman14 +18.15% puttno2 +12.63% smithjjj5 Read More…

In a move that suprised almost no-one, OPEC announced that cuts in production to help prop up oil prices may soon be on the horizon. What was surprising was that US oil producers, who are not affiliated with the group, concurrently cut back production estimates. The change in US estimates is mostly technical; instead of Read More…

Alibaba ([htmwquote]BABA[/htmwquote]) has had a wild ride since its IPO last year. Today, shares are up about 3% from the first day of trading, although that pales in comparison to the heights in November, where they hit about 75% higher than today. Since November, prices have crashed down; their growth is still strong, but investment Read More…

Yesterday index futures around the world started pushing up after China announced a cut to interest rates and banking reserve requirements. That trend continues today, with stock prices in Europe and North America pushing ahead and erasing losses from the past week. China, however, is looking at a different story. The Shanghai Composite Index fell Read More…

Stocks around the world this morning after the Chinese central bank announced interest rate cuts, along with lowered reserve requirements for banks to encourage banks to start lending and put a stop to the global equity selling spree. This comes a week after the same bank drastically de-valued the Yuan, sending stocks, currencies, and futures Read More…

Stocks around the world continued to lose value, over $5 trillion in value has been lost in the last 2 weeks, as investors continue to flee riskier assets after China’s currency devaluation. The move, which many have claimed was a move designed to boost exports, has caused waves all around the world. Investment to developing Read More…

Berkshire Hathaway and 3G capital took control of Kraft foods and Heinz ketchup not long ago, where efforts first focused on Heinz. After replacing most of the top-level management (and many of the juniors), Heinz also shaved thousands of jobs in an effort to cut costs. The efforts seem to have worked; it boasted some Read More…

Everyone paying attention to the news lately knows that there has been a lot of rough water over the last month or so; Gold and Oil have been tanking farther than usual, the Chinese currency devaluation rocked global markets while the Chinese stock market plummetted. Which is, coincidentally, a great time to start looking at Read More…

New data shows that housing starts hit an 8-year high in July, with a construction frenzy underway as the housing market continues on its recovery after the financial crash. Home remodeling activity has been up as well, which helped Home Depot ([htmwquote]HD.N[/htmwquote]) beat earnings estimates and see stock prices reach new heights. There have been Read More…

The world markets are still edgy after China’s currency devaluation last week, and a Fed report showing that New York area manufacturing started sliding downwards has not put any investors at ease. Commodities and stocks both started down on Monday morning, many top analysts predict the pullback will continue for a short while longer as Read More…

The European Union economy was expected to grow by about 0.4% in the 2nd quarter of this year, but researches have determined it missed the mark, coming up only at 0.3%. This may not sound like a big miss, but that tenth of a percent is a lot of money (billions of Euros of unrealized Read More…

The beginning of the week was dominated by the Chinese currency devaluation; the Chinese central bank devalued the Yuan by over 4% from Monday’s exchange rate with the US dollar over the week. However, by this morning, things have returned more-or-less to “normal” on international currency markets. The biggest fear when the devaluation was announced Read More…

Alibaba ([htmwquote]BABA[/htmwquote]) missed its earning target, driving shares farther down for the company that had the world’s largest IPO last year. The news of the Chinese commerce behemoth’s miss came just after China announced another round of currency devaluation, bringing the total drop of the Yuan to almost 4% compared to last week against the Read More…

Tuesday morning China announced an immediate 1.9% devaluation of the Yuan, surpising investors and economists around the world. Bankers around the world have long criticized China for manipulating its currency value in order to help drive exports; this sudden devaluation only strengthens those concerns. The Chinese economy has been facing slowed growth over the last Read More…