In the world of stock analysis, fundamental and technical analysis are on completely opposite sides of the spectrum. Earnings, expenses, assets and liabilities are all important characteristics to fundamental analysts, whereas technical analysts could not care less about these numbers and only focus on price and volume. Which strategy works best is always debated, and many volumes of textbooks have been written on both of these methods.

A Technical Analyst would criticize Fundamental analysis as they consider it worthless because company numbers are frequently cooked and they only come out once a quarter. Government statistics usually have a huge lag time, sometimes months after the time period in question. A Technical Analyst would rather look at market information (price and volume) only. This is where true information is as the institutional buyers have a better inside track and will buy/sell in huge volumes based on their inside knowledge. Therefore, a retail investor should buy things that are going up and sell things that are going down.

A fundamental analyst would say that technical analysis ignores all the valuable information about profit, dividends, growth rates and other information that any CEO would use to judge the value of a company.

The bottom line is that you should do some reading for yourself and figure out which system you feel most comfortable with.

Key Terms

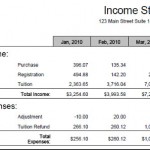

- Fundamental Analysis – Fundamental analysis looks at factors like balance sheets, income statements, profit ratios, the economy, etc.

- Technical Analysis – Primarily focuses on stock price and the volume of stock purchases and sales.

- Technical Indicators / Chart Patterns – A list of Chart Patterns that professional WallStreet traders use on a daily basis.

- Chart Analysis – Focuses on the same factors as a Technical Analyst.

Vicky’s March Trading Strategy

Vicky’s March Trading Strategy What is an Income Statement?

What is an Income Statement?