Definition

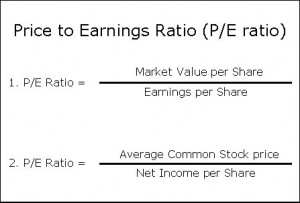

P/E Ratio. It sounds good and makes novice investors feel like they have a grasp of the situation but how valuable is the Earnings Price Ratio? Surprisingly, the price to earnings ratio is a useful tool but certainly not the holy grail of investing as it is sometimes made out to be. For those novice investors, the P/E Ratio provides a numeric representation of the value between the stock price and earnings. To derive the P/E Ratio you divide the share price by the company’s EPS or Earnings Per Share. The formula looks like this: P/E = Stock Price/ EPS

- Market sentiment. An overly optimistic P/E Ratio can indicate the market expects big things from this company. Temper optimism with reality.

- Cover priced or over-bought. A high P/E Ratio can indicate a given stock is priced to high and ready for a correction. Be sure to compare against industry norms.

- Lack of confidence. A low P/E Ratio may indicate a lack of confidence in the future of the company.

- Sleeper. A low P/E Ratio might be a sleeper just waited to be discovered.

Example

For example, if a company is currently trading at $43 a share and earnings over the last 12 months were $1.95 per share, the P/E ratio for the stock would be 22.05 ($43/$1.95).

Coca-Cola and Pepsi operate in the same industry and produce goods that are very similar in nature.

Coca Cola’s (KO:NYSE) stock price (Price per Share): $66

Coca-Cola’s Earnings-per share (EPS): $5.26

Coca-Cola’s P/E Ratio: $66 / $5.26 = 12.55

Pepsi’s (PEP:NYSE) stock price (Price per Share): $69

Pepsi’s Earnings-per share (EPS): $3.73

Pepsi’s P/E Ratio: $69 / $3.73 = 18.50

From our calculations, we can see that Pepsi has a higher P/E Ratio than Coca-Cola.

This could be perceived a couple of different ways:

- Coca-Cola is under-valued and should be bought.

- Pepsi is over-valued and should be sold or shorted.

- Investors do not perceive Coca-Cola as doing as well as Pepsi presently.

- Pepsi is launching a new product that Coca-Cola is not.

The truth is normally some combination of these perceptions.

How to use the P/E Ratio

The P/E Ratio by itself is just a number. Just because it is high or low does not lend much intuition by itself.

But, when we compare P/E ratios between companies and industries, we really start getting the picture for the particular company we are analyzing.

It does not make much sense to compare P/E Ratios of companies across different industries, as each industry has its own unique way of conducting business.

It’s like comparing a doctor with an engineer to see which one is more valuable.

Hence, if comparing P/E ratios, you should compare between companies in the same or similar industries.

You may also compare the P/E ratio of a company to the P/E Ratio of the entire industry that it operates in to analyze whether the stock is over or under-valued.

How to interpret the P/E Ratio

High P/E Ratio may mean:

Market sentiment: An overly optimistic P/E Ratio can indicate the market expects big things from this company. The company has high growth possibilities.

Lifecycle: The company could be entering into the Growth or Shake-Out stage of its lifecycle.

Industry: Specific Industries have a certain level for the P/E Ratios. For example most technology companies have high P/E Ratios.

Cover priced or over-bought: A high P/E Ratio can indicate a given stock is priced to high and ready for a correction. This means that it might be over-valued. Be sure to compare against industry norms.

Low P/E Ratio may mean:

Lack of confidence: A low P/E Ratio may indicate a lack of confidence in the future of the company.

Lifecycle: The company could be in the Mature or Decline stage of its lifecycle.

Industry: Specific Industries have a certain level for the P/E Ratios. For example most utility companies have low P/E Ratios.

Sleeper: A low P/E Ratio might be a sleeper just waiting to be discovered. This means that it might be undervalued, and a perfect time to start buying the shares.

Important Note

- The Earnings-Per-Share in the P/E Ratio formula is a number that comes from the accounting books of the company.

- Hence, it is possible to manipulate the EPS and hence the P/E Ratio in order to trick investors into perceiving the stock differently.

- It is important to independently verify that the company’s’ financial statements are sound and true.

Conclusion

A PE Ratio is an important valuation tool that can give key insights into whether a stock may be over or under-valued.

Also sometimes known as “price multiple” or “earnings multiple.”

BEGINNERS: Learn To Trade Stocks

Click Here to see all Beginner Stock Trading Articles

Spider ETF

Spider ETF Using Spreadsheets – Importing and Formatting Data

Using Spreadsheets – Importing and Formatting Data