Final Rank: 331 / 518

Final Portfolio Value: $985,785,982.85 (-1.42%)

Investment Strategy For This Contest

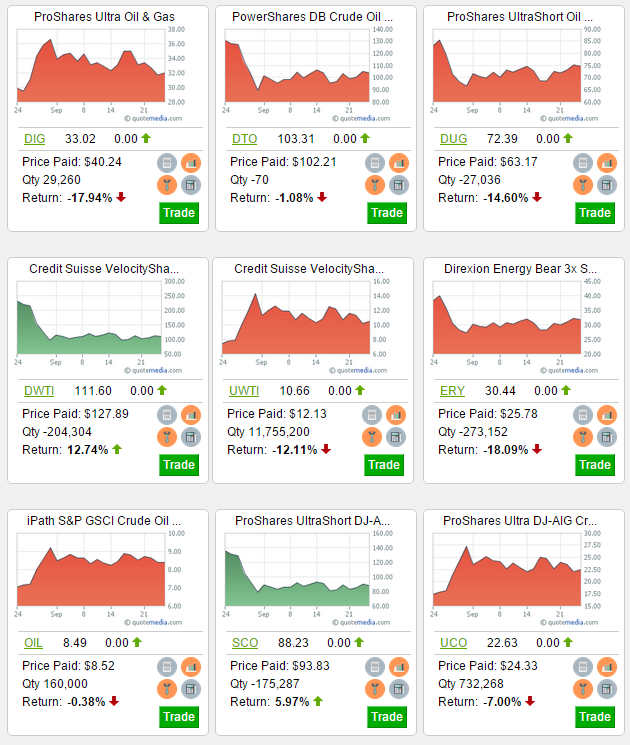

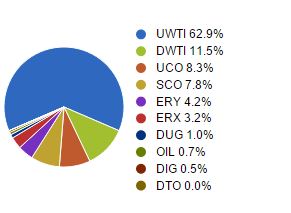

This was a contest where I wanted to go big or crash hard. The news leading up to the contest was dominated by the crash in oil prices, so I figured that there would probably be a rebound coming soon. With that in mind, I bought every double- and triple- leveraged “bull” ETF I could find in the energy sector, and shorted every “bear” ETF they were partnered with.

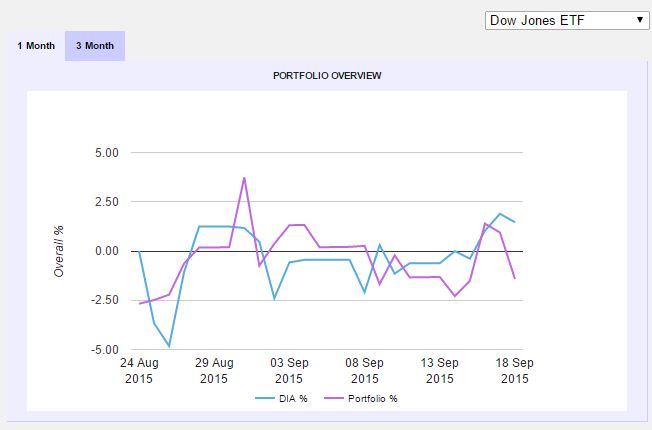

As you can see by my losses and final rank, this didn’t really work out; there was a brief period where oil prices did recover (you can see my short of [hq]DWTI[/hq], a triple-leveraged bear oil ETF, is one of the few positions I had a net gain), and I actually got up to 16th in the overall rankings, but I did not cash out my earnings before prices started falling back down.

I also had a hard time trying to invest all that cash; these leveraged ETFs can have pretty low volume, so I would have to go back day by day and buy up as many shares as I could in the markets, then go back the next day and try again. Days where oil dominated the news gave me lots of volume to work with, other times I couldn’t really increase my positions at all. This did help prevent my losses from growing, but it also meant it was very difficult to close my positions and “Lock In” any profits.

This is actually a common problem with very large hedge funds in the real world; when you are looking to invest amounts of cash greater than what normally trades in a particular stock in a day, you might end up not being able to find enough sellers to buy from! This is especially the case with options trading.

I tried to learn my lesson, and I will be coming back strong in the September Challenge!

Final Open Positions and Portfolio Allocation

Performance Over The Total Contest

Cottage Industry

Cottage Industry Technical Analysis of the Financial Markets

Technical Analysis of the Financial Markets