Fibonacci numbers are a sequence of numbers where each is the sum of the two preceding numbers (1,1,2,3,5,8,13,21,34 and so forth). This sequence of numbers forms various ratios including the infamous “Golden Ratio” which is .618.

Earnings report stock trends, profit and more but making sense of an earnings report can seem daunting especially in light of the catastrophic endings of Lehman Brothers, Enron and Worldcom.

Earnings estimates provide one strong measure of potential future performance and are a mainstay of stock investing research.

Screen stocks by industry, price, volume, market cap, dividend yield, performance, sales and profitability, valuation ratios, analysts estimates, etc.

Return on Equity (ROE) is used to measure how much profit a company is able to generate from the money invested by shareholders.

Price to Earnings is the most usual way to compare the relative value of stocks based on earnings since you calculate it by taking the current price of the stock and divide it by the Earnings Per Share (EPS).

The question of when to sell stocks is not easily answered. On the one hand, you know a correction is coming but the question of “when” isn’t so clear. Anyone who has ever sold early only to stand by and watch others reap in huge profits have felt the pain of premature sales.

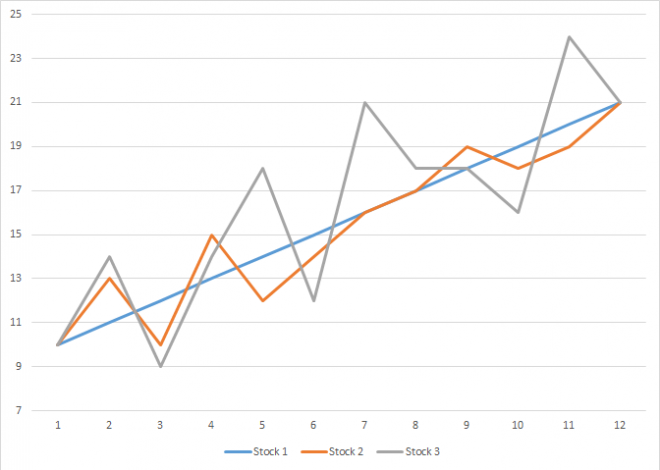

Stock volatility information can be used in many different ways but here is a quick and easy bit of stock volatility information that you can begin using today.

It is impossible to predict what the market will do today, tomorrow or next year, but there is one thing that is definite: markets go up, they go down, and they stay the same.

The golden rule of stock investing dictates cutting your losses when they fall 10 percent from the price paid, but common wisdom just might be wrong. Instead, use some common sense to determine if it’s time to hold or fold.

A hedge fund is one of the investment tools you will aspire toward as a serious investor. The first hedge fund came out in 1949 as a strategy to neutralize the effect of overall market movements on a portfolio.

The Cramer bounce is a theory that the stocks that Jim Cramer recommends on his TV show will almost always increase the day after the show airs.

These international ETFs allow easy trading on American exchanges and they invest only in the best-established, reputable companies of the country.

Small cap stock investing is volatile. That is one of first things you should know and understand. So, why risk your money by investing in what is typically considered risky business?

Hyperinflation refers to out of control or extremely rapid inflation, where prices increase so quickly that the concept of real inflation becomes meaningless.

A CD or Certificate of Deposit is one of the safest and liquid forms of investment available. Insured by the FDIC (Federal Deposit Insurance Corporation), CDs are a type of interest earning deposit account.

In a cap-weighted index, large price moves in the largest components (companies) can have a dramatic effect on the value of the index.

Market risk is a measure of how much of a loss an investor is facing while trading.

Your ideal investment or investment portfolio gives you the most opportunity for the risk you can bear. In this sense, it is important to understand the risk inherent in an investment before you look for the opportunity.

Diversification to reduce risk should seem obvious to most investors but a surprising number of people follow their instinct rather than intellect when it comes to investing.